Best 5 Free Casino No Deposit Bonuses Jul 2024

Content

Further interest rate hikes are predicted to tackle the soaring inflation rate in the UK, which will have a knock-on impact on both mortgage rates and the affordability of new mortgages. Mortgage lenders allow you to book in your next mortgage rates up to six months in advance, so if your deal is nearing expiry, it could pay to contact a fee-free broker ahead of time. First-time buyers with a 15percent cash deposit can secure a two-year fixed rate with Nationwide at 5.09percent, or 4.84percent over five years.

- Oregon.Some taxpayers could get money back after they file their state taxes in 2024.

- Clydesdale Bank – part of Virgin Money group – and Saffron building society have both withdrawn mortgage products for new customers as market jitters continue, writes Jo Thornhill.

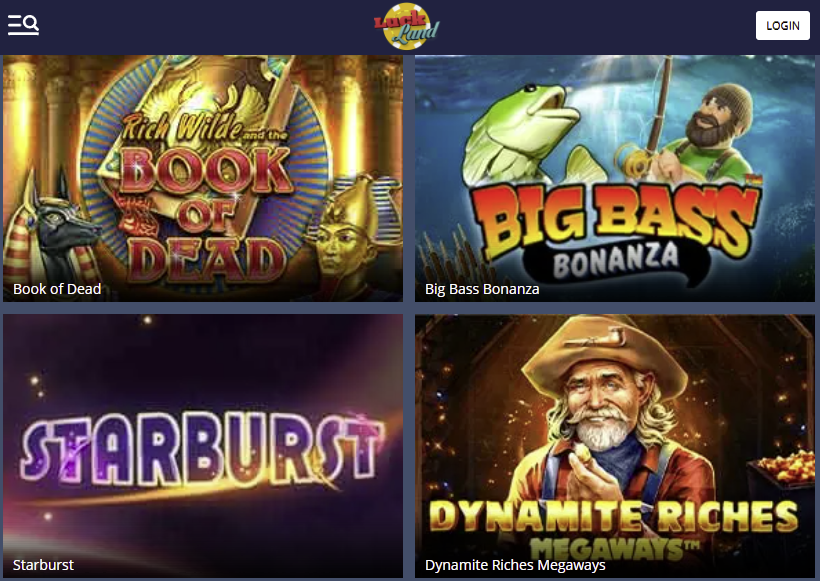

- The main purpose of a no deposit bonus is to give you the chance to try out an online casino’s games.

This is particularly common when developers and casinos are trying to drum up interest in newly released slots. When you have played the bonus funds through, your winnings will appear in your cash balance. You can then withdraw or use them to place additional bets on online slots and table games. A small amount of free cash can be given to new players to explore the casino and try a few casino games on the house.

Borgata Casino

Average costs of a three-year deal stand at 4.63percent, while a typical five-year deal today is priced at 4.42percent. UK Finance’s quarterly Household Finances Review shows mortgage borrowing was significantly reduced https://happy-gambler.com/castle-mania/ at the start of the year, with consumer confidence rocked by rising rates and inflation. Clydesdale Bank – part of Virgin Money group – and Saffron building society have both withdrawn mortgage products for new customers as market jitters continue, writes Jo Thornhill. Santander announced today that it was pulling all mortgage products for new business through intermediaries at the end of today .

February: Lender Bucks Trend Of Cutting Rates

But Platform has since withdrawn its deal and Virgin increased its rate to 3.99percent. Virgin Money is cutting its fixed rate mortgage range for existing customers by up to 0.26 percentage points, writes Jo Thornhill. Swap rates – the interest rates at which banks lend to each other – have increased over the past week causing lenders to reassess the mortgage rates they offer to customers. HSBC has cut its fixed rate buy-to-let and international BtL mortgages by up to 0.3 percentage points. It is offering a BtL five-year fix at 4.64percent (75percent LTV) with a 1,999 fee.

Collect 5 No Deposit At Gratowin Casino

“But when their fixed deal ends they will be facing much higher mortgage costs. Our mortgages expert, Laura Howard, says today’s decision by the Bank of England to raise the UK Bank Rate to 1.25percent will be unwelcome news for the nation’s homeowners and potential buyers. The latest Rightmove price index showed a continued, albeit more modest, rise in property prices last month. According to Mr Bowles, the BoE’s announcement should provide “welcome relief to some would-be-buyers struggling to keep up with current criteria because of significant price growth of the past two years”. The affordability test was introduced in 2014 and revised in 2017. Amanda Aumonier, head of mortgage operations at Trussle, says homeowners should consider remortgaging.

What Makes A Good 5 Free Bonus?

For remortgage deals, the increases will apply on lending up to 75percent loan to value. Virgin Moneyis nudging up selected fixed rates for new and existing customers by up to 0.1 percentage point from 8pm tonight. Broker exclusive residential remortgage deals at 60percent LTV and 70percent LTV as well as some buy-to-let mortgage costs will rise by the full 0.1 percentage point. Its five-year fixed rate for home purchase has fallen to 4.29percent with a 995 fee, for borrowers with at least a 40percent cash deposit (60percent loan to value). Barclaysis increasing selected fixed rates for residential purchase and remortgage.

What Can I Do With A Free 5 Casino No Deposit Bonus?

Its two-year tracker rate deals now start at 5.59percent (tracking at 0.34 percentage points above the Bank of England base rate) with a 999 fee (60percent LTV). The move comes ahead of the Bank of England’s latest Bank Rate announcement, due at 12pm tomorrow . Forecasters are predicting that the rate, which influences what lenders charge their customers, will be held at 5.25percent. The mutual’s best-buy deal has a 999 fee and is available to home buyers with at least 40percent deposit to put down towards their new home. Lower inflation means the Bank of England is less likely to increase the Bank Rate (currently at 5.25percent) any further.

It has a 10-year remortgage fixed rate at 3.99percent at 75percent LTV with a 995 fee. Its buy to let remortgage five-year fixed rate is 4.59percent at 50percent LTV with a 3,995 fee. Broker-only lender Foundation Home Loans has cut rates by up to 0.9 percentage points for residential and buy-to-let mortgages. Its five-year fixed rate deal for owner-occupier borrowers is 6.59percent, at 75percent LTV with a 1,495 fee.

No comments yet.